10

2024

-

11

The global semiconductor industry has staged a "marriage" boom

According to reports, Flex Logix is a reconfigurable computing company that provides leading eFPGA, DSP/SDR, and AI inference solutions for semiconductor and system companies.

Over the weekend, news of ADI's acquisition of Flex Logix's embedded FPGA assets immediately caught the industry's attention. Flex Logix, an American company that designs reconfigurable AI chips, has sold its embedded FPGA assets to Analog Devices (ADI), which also hired the technology team, as reported by eenewseurope on November 10. Flex Logix's eFPGA technology may be added to ADI's low-power MAX microcontrollers, which feature hard-wired ML accelerators to provide greater flexibility. The company did not disclose terms of the deal or any further details at this time.

According to reports, Flex Logix is a reconfigurable computing company that provides leading eFPGA, DSP/SDR, and AI inference solutions for semiconductor and system companies. In 2020, Flex Logix launched an AI accelerator chip, InferX X1, for consumer devices and high-volume applications, based on a configurable interconnect fabric borrowed from its eFPGA, which was sold in 2023. It is reported that the company's eFPGA customers include DARPA (Defense Advanced Research Projects Agency) and other U.S. government projects, as well as Dialog Semiconductor, Renesas Electronics, etc

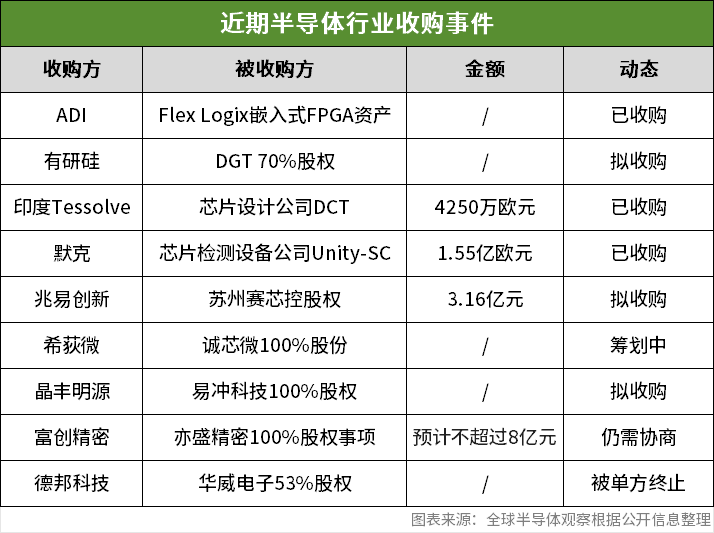

In recent years, the semiconductor industry has ushered in a wave of mergers and acquisitions, each of which means the accelerated flow of capital, as well as the deep integration of technology and market, and promotes industry consolidation and reshuffle. In addition to the above-mentioned acquisitions, there have been a number of mergers and acquisitions in the semiconductor market recently: India's Tessolve acquisition of the German chip design company DCT, Merck's 155 million euro acquisition of chip testing equipment company Unity-SC, GigaDevice plans to acquire a controlling stake in Suzhou Saixin for 316 million yuan, Xidi Micro plans to purchase 100% of the shares of Chengxin Micro, and Youyan Silicon plans to acquire 70% of the shares of DGT and focus on the field of etching equipment components.

Key words:

Related News